|

| Harris A. Neil Jr. yearbook picture 1952, Michigan State |

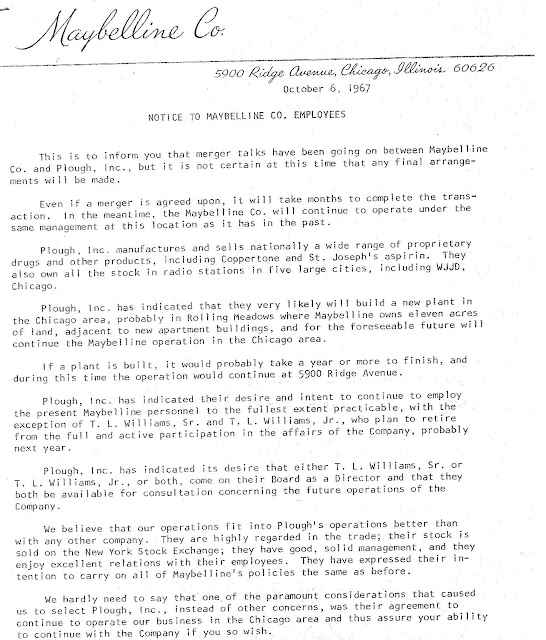

Letter to Maybelline Co. Employees from Tom Lyle Williams Jr., dated October 6, 1967

Article in the Chicago Tribune, Dated Saturday, Oct. 7, 1967.

MAYBELLINE and PLOUGH AGREE TO MERGER PLAN

102.3 Million

Article in the Wall Street Journal October 6, 1967

Plough was quickly and shrewdly chosen as the suitor: They offered a minimum of $100M and there was a period of grace, whereupon the stock would float, then a specific day, which was 2/28/68 that the Plough stock price would be "pegged" for the official exchange. On 2/28/68 the price of Plough had rallied so dramatically that the effectual buyout of the Maybelline company was now $132.3M! Yes, it was leverage that caused this! Demand plus fewer shares caused a stock breakout, which is a scenario seen on Wall Street each day.

$132,000,000 of 1967 dollars would be worth: $923,076,923.08 in 2013

Stay tuned tomorrow as the drama unfolds in letters from Abe Plough to his new employees at Maybelline.

No comments:

Post a Comment